Examination of Lack of Financial Oversight in BakerRipley’s Partnerships with Harris County

BakerRipley’s collaborations with Harris County, while positioned as vital for community support, have repeatedly raised red flags regarding financial oversight, transparency, and the efficient use of taxpayer dollars. Programs like the Emergency Rental Assistance Program (ERAP), small business support initiatives, and utility assistance have funneled millions in public funds to the nonprofit, yet audits and public scrutiny reveal persistent issues: overpayments, inadequate documentation, potential duplications of benefits, and—most egregiously—administrative fees that can reach up to 25% of program budgets. These fees, which translate to substantial windfalls for BakerRipley, often exceed industry norms and divert resources from direct aid to overhead, prompting questions about whether the county is prioritizing accountability or perpetuating a cycle of unchecked spending.

Exorbitant Administrative Fees: A Drain on Public Resources

At the heart of the criticism is BakerRipley’s practice of charging administrative fees as high as 25% on county-funded programs, a rate that critics argue is unjustifiably inflated for a nonprofit ostensibly dedicated to community service. In a recent example from October 2024, Harris County Commissioners approved an additional $30 million allocation to BakerRipley for various initiatives, bringing the total county funding to $50.7 million. This triggered concerns from Commissioner Tom Ramsey, who highlighted that the 25% admin fee would amount to $12.5 million—funds that could otherwise support more direct aid to struggling residents rather than padding the nonprofit’s operational costs.

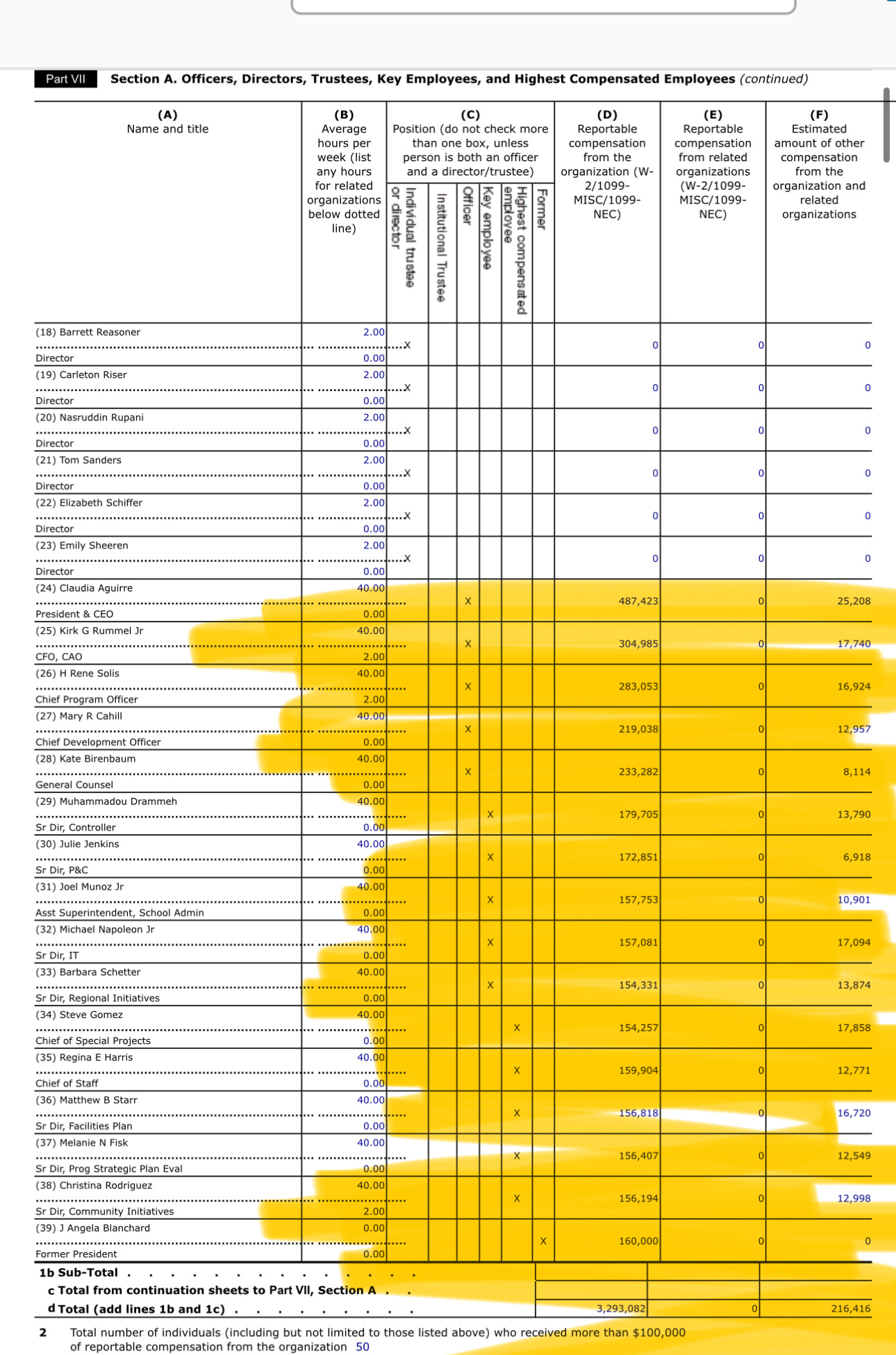

Such fees are not isolated incidents. In the ERAP, BakerRipley’s compensation ranged from 6-7.5% of program funds (e.g., $2.25 million on a $30 million initial allocation), but these percentages compound across multiple rounds and programs, leading to multimillion-dollar payouts. For context, typical administrative fees for nonprofits handling government contracts often fall between 5-15%, with overhead ideally kept under 35% to ensure the majority of funds reach beneficiaries. A median cost share for similar government-nonprofit arrangements is around 25-30%, but this is often justified only when nonprofits subsidize programs with their own resources—not when they’re profiting handsomely from public grants. BakerRipley’s 25% cut stands out as excessive, especially given the organization’s scale and the fact that these fees contribute to high executive salaries, as previously noted (e.g., CEO compensation over $500,000 annually).

Critics, including local watchdogs and media outlets like Dolcefino Consulting, argue that these fees exemplify a lack of fiscal restraint, allowing BakerRipley to siphon off a disproportionate share of funds intended for vulnerable populations. In the context of Harris County’s budget woes—marked by deficits, rising taxes, and neglected infrastructure like pothole repairs and flood control—this arrangement borders on irresponsible stewardship of taxpayer money. Why, detractors ask, does the county continue to award contracts with such high overhead allowances when smaller fees could free up millions for direct services?

Flawed Oversight and Recurring Audit Red Flags

Financial oversight in these partnerships has been woefully inadequate, as evidenced by multiple audits uncovering systemic problems. The 2022 Harris County Auditor’s follow-up on the ERAP, informed by Guidehouse’s monitoring, exposed over $864,000 in overpayments to landlords, with $405,000 still unrecovered as of early 2022. Issues included duplicate payments ($418,000 identified), payments exceeding caps, and disbursements for ineligible periods, stemming from poor system design, staff errors, and insufficient verification processes. Additionally, 562 cases showed potential overlap with other federal housing subsidies, risking $531,000 in duplicated benefits and violating guidelines like the Robert T. Stafford Act.

BakerRipley’s responses—recovering partial amounts ($203,000 by March 2022) and updating policies—fall short of addressing root causes, such as failing to record overpayments as accounts receivable, breaching GAAP standards. The nonprofit disputed some liabilities, citing evolving Treasury guidelines and contract terms, but this deflection ignores the compressed timelines and lack of shared draft reports that hampered effective oversight. Broader investigations, including a 2023 U.S. Treasury OIG review and calls for audits by Commissioner Ramsey, highlight questionable payments in ineligible neighborhoods and potential fund misuse.

Compounding these issues is BakerRipley’s $1.3 million settlement in 2023 for allegedly misspending grants on “sham products and services,” further eroding trust in its financial practices. Harris County’s continued funding—despite these lapses—suggests a failure in due diligence, prioritizing partnerships over rigorous accountability. Public commentators on platforms like twitter have decried this as potential corruption or embezzling of taxpayer funds, urging interventions from state authorities.

Implications for Taxpayers and Recommendations

This pattern of high fees and lax oversight undermines the intended impact of programs like ERAP, Harris Hub, and utility assistance, where millions in aid were distributed but marred by inefficiencies that left funds unrecovered or misallocated. In a county grappling with budget deficits and calls for tax hikes, such arrangements exacerbate inequities, benefiting nonprofit executives while shortchanging residents facing evictions, utility shutoffs, or business closures.

To rectify this, Harris County should impose stricter fee caps (e.g., 10-15%), mandate independent audits for all contracts, and explore in-house administration to reduce overhead. Until then, BakerRipley’s partnerships risk being seen not as community empowerment but as a taxpayer-funded gravy train.

This is a very informative article! I would like to see a follow up with names named. Who are the Houstonians involved in this supposedly non-profit organization! Who are the “community leaders” who should be overseeing this organization and why haven’t they. Is that not the purpose of a board of directors - or is there some other reason?