Rising Electricity Rates: The Hidden Costs of the Data Center Boom.

Rising Electricity Rates: The Hidden Cost of America’s Data Center Boom

In an era dominated by artificial intelligence, cloud computing, and digital infrastructure, the United States is witnessing a sharp escalation in electricity rates, particularly in regions housing massive data centers. These facilities, essential for powering everything from social media to machine learning models, are devouring unprecedented amounts of energy, straining power grids and driving up costs for businesses and consumers alike. As of late 2025, this trend shows no signs of abating, with projections indicating even steeper increases ahead.

The Explosive Growth of Data Centers

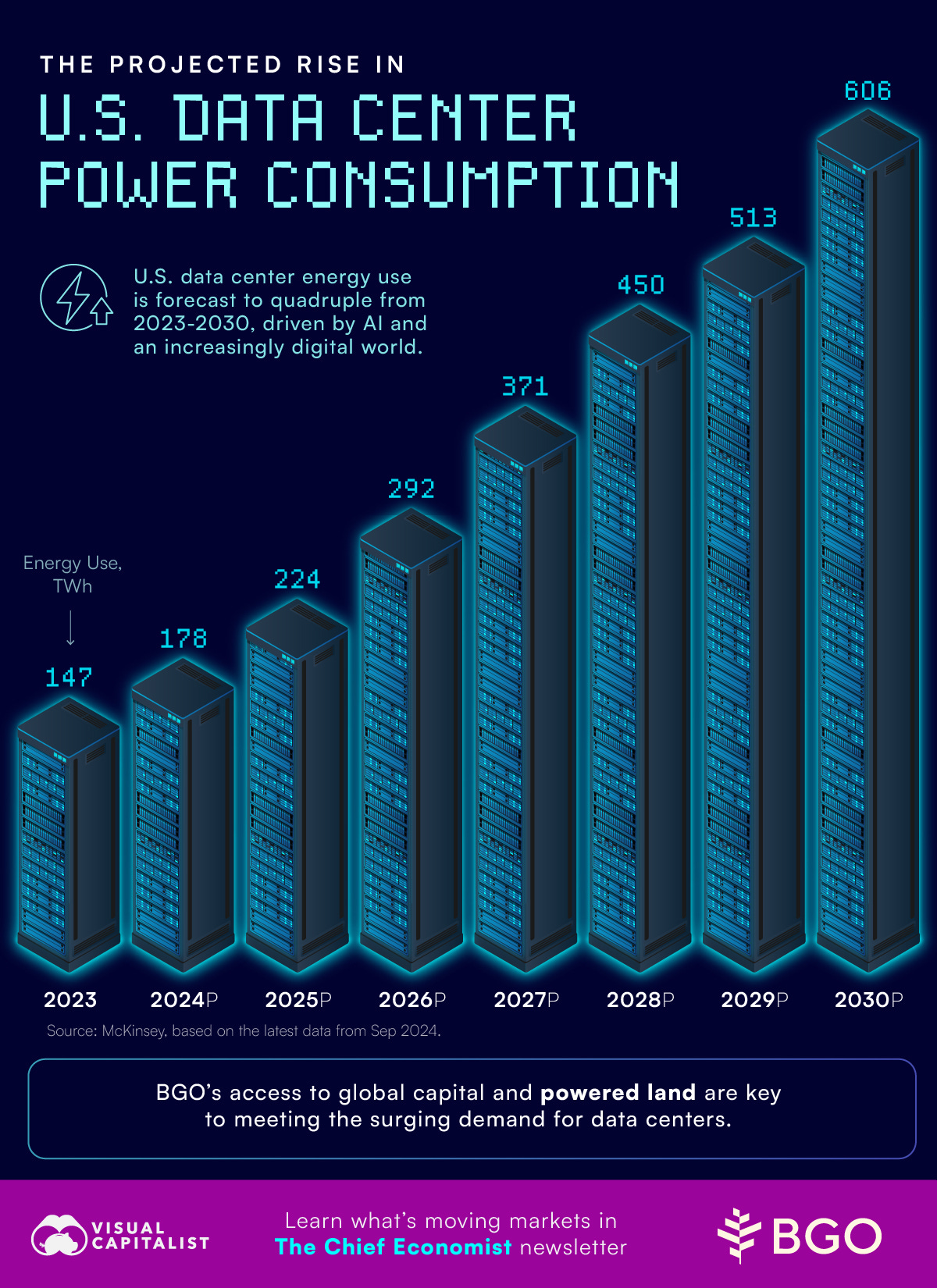

The United States is experiencing explosive growth in its data center industry, fueled primarily by the surge in artificial intelligence (AI), cloud computing, and digital infrastructure demands. As of late 2025, data centers are consuming around 4% of the nation’s total electricity, a figure projected to more than double by 2030, potentially reaching 9% of U.S. electricity usage. This rapid expansion is driven by hyperscale operators like Amazon Web Services (AWS), Microsoft, and Google, which are investing heavily in AI capabilities. For instance, eight major hyperscalers anticipate a 44% year-over-year increase in spending on AI data centers and computing resources, totaling $371 billion in 2025 alone. Overall, utility-provided power to hyperscale, leased, and crypto-mining data centers is expected to rise 22% in 2025, reaching about 61.8 gigawatts (GW), with projections climbing as high as 106 GW by 2035 in more aggressive estimates.

This boom is reshaping the U.S. economy, creating jobs in construction and operations while straining power grids and prompting billions in infrastructure investments. However, challenges like near-zero colocation vacancy rates—indicating severe supply constraints—and rising energy costs are emerging as bottlenecks, potentially undermining economic growth and national security if not addressed. Construction spending on data centers is bucking broader trends, with significant under-construction capacity signaling continued momentum despite a slight dip in overall U.S. building activity. As of 2025, the U.S. hosts over 4,000 facilities from more than 1,700 operators, but a handful of markets dominate in terms of density and capacity.

The Surge in Demand and Its Ripple Effects

Data centers have become the voracious consumers of the energy sector. Nationally, these operations accounted for over 4% of U.S. electricity consumption in 2024—equating to approximately 183 terawatt-hours—a figure that has risen dramatically from previous years. Experts forecast this demand could more than double by 2030, potentially reaching 9% of total U.S. electricity use by 2035. This explosive growth is fueled by the AI revolution, where companies like Google, Amazon, and Microsoft are expanding their server farms to handle complex computations.

The consequences are evident in wholesale electricity prices, which have more than doubled in some markets since 2020, with spikes as high as 267% in areas densely populated by data centers. The U.S. Energy Information Administration (EIA) predicts average wholesale prices will climb to $47 per megawatt-hour (MWh) in 2025—a 23% increase from 2024—before rising further to $51/MWh in 2026. Key contributors include data centers and cryptocurrency mining, particularly in high-demand states like Texas, where electricity sales could surge by 9.2% in 2026.

Beyond direct consumption, the expansion of data centers is imposing billions in additional costs on the grid. In the PJM Interconnection, which serves parts of 13 states and the District of Columbia, recent data center growth has added $9.3 billion to a $14 billion capacity bill for the 2025-2026 period, with cumulative costs projected to reach $163 billion through 2033. Utilities are passing these expenses onto ratepayers, leading to broader hikes that affect households and industries.

Regional Hotspots: Where the Pain is Most Acute and Density is Highest

Data centers tend to cluster in regions with reliable power, fiber-optic connectivity, tax incentives, and proximity to major population centers or tech hubs. The impact of rising rates varies by region, with data center hubs bearing the brunt, often overlapping with areas of high density.

• Northern Virginia (Ashburn and Loudoun County): Often called “Data Center Alley,” this is the world’s largest data center market by far, with over 300 facilities and nearly 6,000 MW of active capacity, plus another 6,300 MW planned. Under-construction capacity surged 80% in the first half of 2025 to 2,078 MW, driven by low energy costs, robust internet infrastructure, and proximity to Washington, D.C. Major players like AWS and Equinix have massive footprints here, making it a hotspot for hyperscale expansion. Peak load from data centers could surge 75% by 2039, leading to proposed residential rate increases of about $20/month over the next two years.

• Dallas-Fort Worth (Texas): Emerging as the top growth market in 2025, DFW recorded its largest quarterly net absorption ever in Q3, solidifying its status as a key hub. The area benefits from Texas’s deregulated energy market, abundant land, and incentives, attracting investments from companies like Meta and Google. It’s one of the top five markets for land competition, with high density in colocation and edge facilities. Data centers are the largest new power consumers here, exacerbating summer demand spikes and price volatility.

• Phoenix (Arizona): Known for its dry climate (ideal for cooling) and renewable energy access, Phoenix is a rapidly densifying market with significant under-construction projects. It’s among the top U.S. areas for data center land heating up in 2025, hosting facilities from Vantage Data Centers and others, with a focus on sustainable power sources to support AI workloads.

• Atlanta (Georgia): This southeastern hub is gaining traction due to tax breaks, low power costs, and strong connectivity. It’s a top-five market for growth, with dense clusters supporting cloud services and enterprise needs, including expansions by operators like Digital Realty.

• Chicago (Illinois): As a Midwest powerhouse, Chicago offers Midwest reliability with high-capacity facilities, drawing investments for its central location and fiber networks. It’s another top market for land and development in 2025, with dense urban and suburban data centers serving financial and tech sectors. The broader Midwest region is also seeing data centers as major new power consumers, contributing to price volatility.

• Baltimore Area: Wholesale price spikes here have contributed to residential electricity bills soaring by up to 80% over the past three years, highlighting how localized demand can exacerbate costs.

Other notable dense areas include Northern California (Silicon Valley), with its tech ecosystem proximity, and New York/New Jersey, which handles high-volume financial data. Upcoming mega-projects, such as Microsoft’s Stargate AI campus and Meta’s Monroe facility, are further concentrating capacity in states like Arizona, North Carolina, and Georgia.

While natural gas prices and other factors play a role, data centers remain the primary driver in these high-growth zones.

Looking Ahead: Projections and Potential Solutions

As the digital economy expands, so too will the strain on energy resources. Without intervention, rate hikes could become a persistent challenge, potentially stifling economic growth or leading to reliability issues during peak periods.

Experts advocate for proactive measures to curb these escalations. Improved load forecasting could help utilities anticipate demand more accurately, while policies requiring data centers to invest in energy efficiency or on-site renewables—such as solar or wind integration—might alleviate some burdens. Some companies are already exploring nuclear power or advanced cooling technologies to reduce their footprint, but widespread adoption is needed.

In conclusion, the booming data center industry is a double-edged sword: it drives innovation but at a mounting energy cost. Policymakers, utilities, and tech firms must collaborate to ensure sustainable growth, preventing these rate increases from becoming an insurmountable barrier in the AI age.

Fractal out of Austin says the big data centers being built needing soooo much energy are using out dated technology & aren’t necessary.. check it out