Why is Harris County Hiding a Damning Audit Report on BakerRipley's Rental Assistance Program?

A few days ago a friend was able to obtain the audit performed on BakerRipley’s Emergency Rental Assistance Program the county has been pouring $100s of millions into, the findings are alarming to say the least.

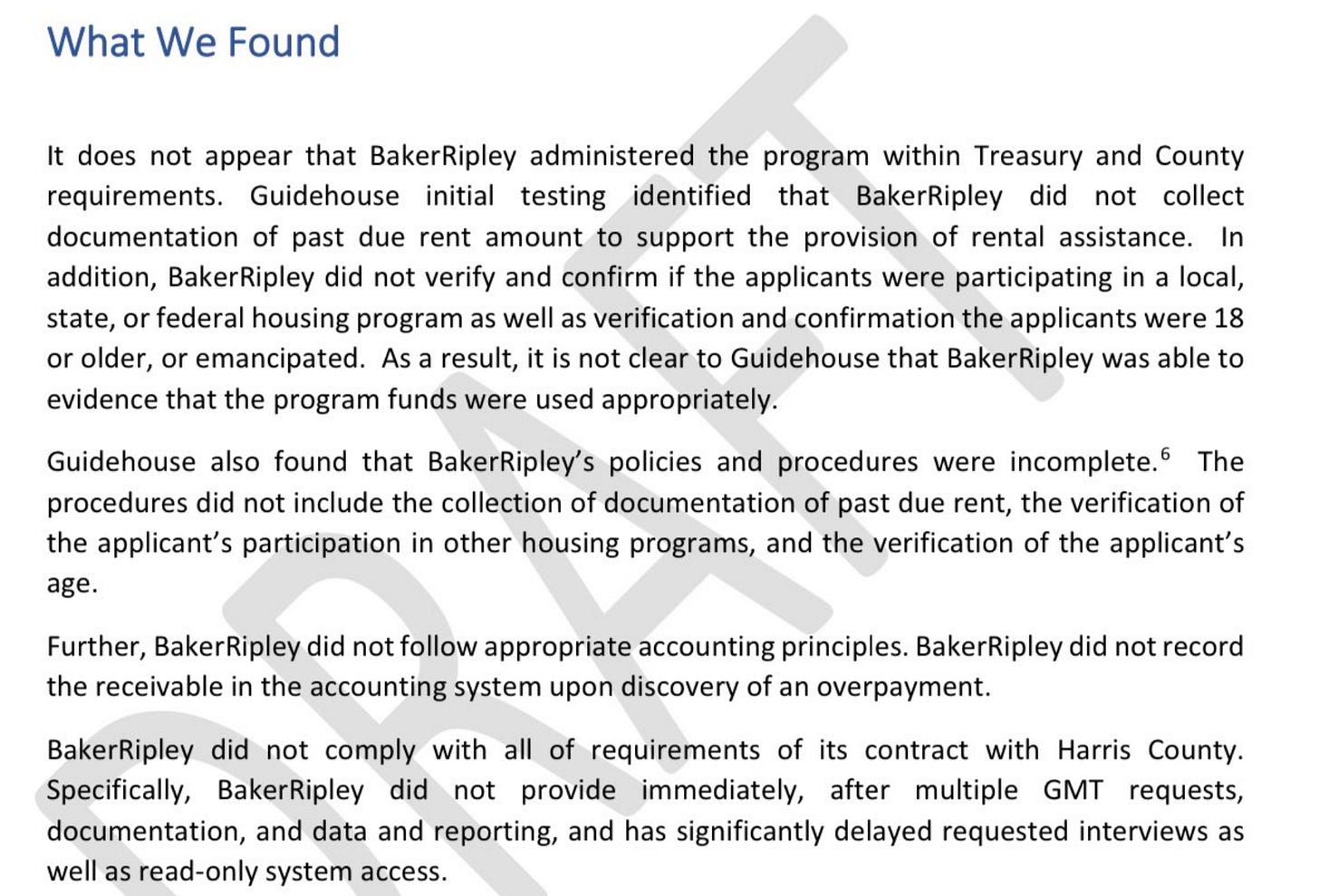

Executive Summary A. Background On June 30, 2020, the Harris County Commissioners Court established the Rental Assistance Program (“RAP”) in the amount of $15 million, and on July 14, 2020 Harris County executed an agreement1 with BakerRipley to administer the program. The RAP was amended on August 25, 2020, to increase the total amount to $40 million. The RAP assists with rent and associated expenses2 for prior month’s payments in arrears occurring after April 1, 2020. Initially, the program was designed to assist with past due rental assistance for April through August 2020 for up to $1,900. On November 10th, the assistance was extended to assist applicants with another round of assistance for past due September through November rental payments. Families could apply for assistance for both periods (April to August and September to November) and receive up to $3,800. Harris County contracted Guidehouse to perform the compliance monitoring and reporting of the RAP, and this document reflects the compliance monitoring work performed from September 14, 2020 – March 24, 2021. B. Overview of Guidehouse Observations Our work included documentation request(s), interviews and file testing . Based on our review and observations during the monitoring period, Guidehouse (or “the monitoring team” or “GMT”) performed testing and identified the findings and concerns listed below. The report includes high level results, which are categorized as Findings and Concerns. A Finding is a violation of a statutory, regulatory or program requirement for which sanctions or other corrective actions may be issued. A Concern is a deficiency in program performance not based on statutory, regulatory or other program requirements. The County should work with the administrator to resolve findings by identifying a corrective action plan and recoupment of improper payments. If a finding or concern is not adequately addressed by the administrator, it could present future risk to the County , up to and including, recoupment of funds. 1. High Level Summary – Findings and Concerns The GMT performed reviews, the scope of which included BakerRipley’s system(s), processes, and file reviews. If a formal response from BakerRipley to the findings identified in this report was not received, as of the date of this report, the findings remain open and the County should work with the administrator to determine the corrective action taken. This high-levelsummary is meant to summarize the findings and concerns. Please review the Detailed Findings and Concerns for a more comprehensive explanation. 1 See Appendix A 2 Associated expenses include trash, water, sewer, pet rental, etc 5 a. Findings3 i. Policies and procedures were incomplete4 . The policies, procedures, and workflows did not include the verification of (per County program guidelines): (a) Proof of Unpaid Rent (b) Eligibility/Proof of Age (c) Eligibility/Participation in other Housing Programs ii. The payment process led to overpayments to landlords. The process did not allow time for the landlords to review and confirm the rental assistance payment before it was disbursed. Payments for months not owed, and overpayments could have been reduced or prevented. 207 landlords were determined to have been overpaid for a total of $203,417. BakerRipley had recouped $108,458 of the total as of last reporting. The GMT did not receive an updated overpayment report, nor do we know the total overpayment or recouped amounts. iii. Accounting of Overpayments. BakerRipley did not follow proper GAAP accounting principles regarding landlord overpayments. BakerRipley recorded the receipt of funds when the overpayment was refunded by the landlord but did not record the receivable in their accounting system once they were informed by the landlords that they had been overpaid. As a result, BakerRipley did not have accurate record of their Accounts Receivables. iv. Applicant File Documentation. BakerRipley did not always ensure all documents in the files were present in the applications, or that they were properly completed. The table below summarizes the file review of 289 files in which assistance was provided

Program system capabilities. Connective, the system of record, did not always perform as intended. a. Duplicate Payments. The system did not properly identify multiple applications for the same household causing duplicate payments. GMT found 586 files that had duplicate payments.

BakerRipley requested 392 repayments from landlords, 7 files were not considered duplicates. The GMT is not aware if BakerRipley reviewed the remaining 187 files. GMT estimates that the potential overpayment amount could add up to $118,017, for the remaining 187 files. b. Overpayments (Payments above $1,900). The system did not correctly cap the total assistance allowed of $1,900 per round causing overpayments. GMT found 376 files that had overpayments.

BakerRipley stated that all landlords affected received a refund request letter. As of March 12, 2021 161 overpayments have been received. c. Payments assistance beyond November 2020. The system did not correctly cap the assistance of months rent to November and allowed disbursements for December

BakerRipley explained that this was due to a system glitch and that all landlords affected received a refund request letter and the system was documented accordingly. d. Payments for months not owed. The system allowed users to update the application status during the time between the pre-payment report and the post-payment report causing payments for months not owed to be overlooked. BakerRipley stated that all landlords affected received a refund request letter and the system was documented accordingl

Potential Fraud. The GMT found four cases associated with potential fraudulent applications. In two instances, the applicant (tenant) was also the landlord. In one instance, the applicant submitted two applications using her first and second name, and different email addresses. In the last instance, two different members of the household submitted applications

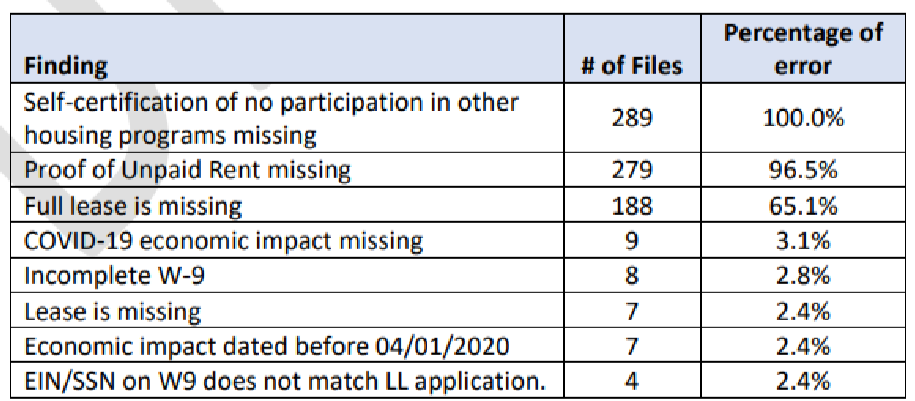

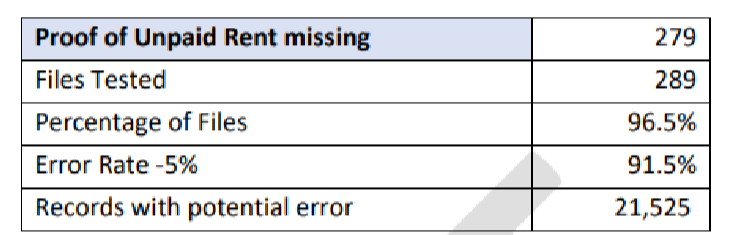

BakerRipley stated that they sent a refund letter to the landlords affected after the GMT alerted them of the potential fraudulent applications. It is unknown to the GMT if funds were recovered. b. Concerns5 i. Staffing. The GMT identified that BakerRipley did not have dedicated staff for certain key functions: a. BakerRipley performed the processing for three different rental assistance programs concurrently (Harris County, City of Houston, and El Paso) with the same staff. b. BakerRipley also utilized application processors to staff the call center, taking them away from processing applications. c. BakerRipley did not conduct Compliance and Quality Assurance (“CQA”) to gain insight into their processes for compliance with requirements of regulations and procedures. Guidehouse learned through interviews that BakerRipley had not performed CQA. Fraud cases, overpayments, and incorrect payments could have been identified early in the program and overpayments could have been reduced or prevented. CQA staff was redeployed to pull file documentation for the GMT’s testing. ii. Potential ineligible payments. Company/Property Status and Case Closed Reason. a. We looked at the population report as of 02/24/2021 and found a total of 810 “Assistance Provided” applications that have an ineligible Company/Property Status with a total payment of $996,156.83 and 43 applications with an ineligible Case Closed Reason with $51,296.25 total payment. The ineligible status and case closed reason could potentially mean the assistance was incorrectly paid. 5 Detail behind all findings and concerns listed in this high-level view section can be found in Section VI. Monitoring Results and the Appendix. 8 iii. System Capabilities. The system lacked a mechanism for follow-up of requested documentation, potentially delaying approval and payment. a. Connective, the system used for processing applications, maintaining correspondence, and producing pledge reports for payment, did not have an aging capability or a reminder mechanism to assist staff in managing follow up requests for outstanding documentation when the application was in “In Progress” and “Eligibility Review Issue” status. The lack of aging reports and reminders could have delayed processing of applications that were complete. b. The GMT learned through interviews that not all correspondence was required to be processed through or included in Connective. Processors could receive documents from the applicants through general email inboxes. This procedure could potentially lead to the loss of documents or delays in processing, which could present an audit risk if these documents are not able to be made available to auditors. iv. Lack of System Development Artifacts. The GMT requested, but BakerRipley did not provide, documentation regarding System Development Artifacts for the respective system enhancements supporting the Rental Assistance program. These documents include use cases, test scripts, etc. v. Administrator Responsiveness. BakerRipley’s Lack of responsiveness had been an impediment for the GMT team since the beginning of the compliance monitoring to perform timely and appropriate program review. The GMT had to make multiple requests with repeated follow ups to obtain information, data, or schedule interviews. The GMT found a number of issues that could have been reduced or prevented during the program. In the efforts to close this monitoring review, the GMT sent on March 15, 2021 a report to BakerRipley with the findings found during the testing phase. A follow-up email was sent on March 22, 2021. To date, we have not received a response. II. Introduction and Overview A. Introduction In response to the COVID-19 public health emergency, Congress passed the CARES Act which provided over $2 trillion of fast and direct economic assistance for American workers, families, and small businesses, and to preserve jobs for our American industries. The CARES Act established a $150 billion Coronavirus Relief Fund (CRF) to provide relief to States and eligible units of local government. Harris County received a direct allocation of $426 million. 9 On June 30, 2020, the Harris County Commissioners Court established the Rental Assistance Program (“RAP”) in the amount of $15 million and on July 14, 2020 Harris County executed an agreement with BakerRipley to administer the program. The RAP funds are divided equally amongst the 4 Precincts. Precincts 1 and 2 also include the City of Houston. Landlord enrollment began on August 17th, and tenant enrollment for Round 2 began August 24. The RAP was amended on August 25, 2020, to increase the total amount to $40 million. $30 million was disbursed in total as $10 million was reassigned to the Direct Assistance Program. The RAP assisted with rent and associated expenses for prior month’s payments in arrears occurring after April 1, 2020. Initially, the program was designed to assist with past due rent for April through August 2020 for up to $1,900. On November 2nd, the assistance was extended to assist families with past due September through November payments. Families could apply for assistance for both periods (April to August and September to November) and receive up to $3,800. As Administrator, BakerRipley was required to comply with the monitoring requirements outlined in 2 CFR 200.331. Part (d) of CFR 200.331 required the County to monitor the activities of BakerRipley as necessary to ensure that the funds were used for authorized purposes, in compliance with Federal statutes, regulations, and the terms and conditions of the scope of services; and that program performance goals were achieved. Harris County monitoring of BakerRipley included: Reviewing financial and performance reports required by Harris County. Following-up and ensuring that BakerRipley took timely and appropriate action on all deficiencies pertaining to the program funds detected through audits, on-site reviews, and other means. Issuing a management decision for audit findings pertaining to the program funds provided to BakerRipley from Harris County as required by § 200.521 Management decision. As part of the County’s effort to utilize CARES Act funds in accordance with all federal, state, and local requirements, Guidehouse was contracted to perform compliance monitoring and reporting. The County was responsible for determining the adequacy of performance under subrecipient agreements, funding agreements, contracts, and for taking appropriate action when performance problems arouse. The County/Guidehouse should monitor to verify compliance with executed agreements, applicable state and federal laws and regulations, and project/program performance criteria. B. Overview Harris County Commissioners Court approved on July 14, 2020 the agreement with BakerRipley to administer the Rental Assistance Program. The program included two phases - Round 2, which began August 24th, consisting of rental assistance for the months of April through August 2020. Round 3, which started on November 2nd, allowed tenants to apply for rental assistance for the months of September through November 2020. Applicants who were assisted in Round 2 could also apply for Round 3 rental assistance. 10 The Guidehouse Monitoring Team (“the Monitoring Team”, or “Guidehouse”, or “GMT”) was responsible for reviewing BakerRipley as part of the County’s commitment to ensuring that the CRF funds were used according to program requirements. Our objective was to determine whether BakerRipley administered the Rental Assistance Program in accordance with U.S. Department of the Treasury (Treasury) requirements and Harris County program requirements, and specifically, whether BakerRipley followed its own policies and procedures and whether it was compliant with its contract requirements, as set forth in the Agreement between Harris County and BakerRipley, executed July 14, 2020 (“contract with Harris County”). III. What We Found It does not appear that BakerRipley administered the program within Treasury and County requirements. Guidehouse initial testing identified that BakerRipley did not collect documentation of past due rent amount to support the provision of rental assistance. In addition, BakerRipley did not verify and confirm if the applicants were participating in a local, state, or federal housing program as well as verification and confirmation the applicants were 18 or older, or emancipated. As a result, it is not clear to Guidehouse that BakerRipley was able to evidence that the program funds were used appropriately. Guidehouse also found that BakerRipley’s policies and procedures were incomplete. 6 The procedures did not include the collection of documentation of past due rent, the verification of the applicant’s participation in other housing programs, and the verification of the applicant’s age. Further, BakerRipley did not follow appropriate accounting principles. BakerRipley did not record the receivable in the accounting system upon discovery of an overpayment. BakerRipley did not comply with all of requirements of its contract with Harris County. Specifically, BakerRipley did not provide immediately, after multiple GMT requests, documentation, and data and reporting, and has significantly delayed requested interviews as well as read-only system access. IV. Monitoring Approach Guidehouse’s approach to monitoring traditionally leverages desk reviews or onsite monitoring of a program at any time throughout the program lifecycle. However, given the nature of the COVID-19 public health emergency, the team has shifted to utilizing remote desk reviews for all monitoring efforts. A remote desk review is generally a comprehensive evaluation of the administrator that assesses all aspects of the activity being carried out including, but not limited to, procurement activities of all types, payroll and expense documentation, reimbursement requests and payments, key staff roles and responsibilities, management systems and tools, internal controls, and specific project policies and procedures. In some instances, a review may be oriented toward assessing performance in specific areas based on information and documentation available to the compliance monitor. In either case, the administrator is required to cooperate with the monitoring staff and provide all records and files pertaining to the project, as well as any other information requested. A summary of Guidehouse’s planned monitoring approach for this engagement is outlined below:

The GMT kicked off the monitoring review with an entrance conference. Upon completion of the review, the Monitoring Team informed the County of any findings or deficiencies and then met with BakerRipley to discuss the team’s findings. The Monitoring Team worked with BakerRipley to identify strategies to remediate any deficiencies. Issues that could not be immediately remediated are outlined in this final monitoring letter and identified as Findings or Concerns. V. Identification of Risks, and Risk Assessment A. Discussion, Program Review, and Identification of Risks The Monitoring Team held an initial kick-off call with the BakerRipley’s team on September 14th, 2020 to discuss our monitoring approach, the initial documentation being requested, interviews to be performed and timeline to begin our monitoring and compliance work. BakerRipley stated they were unable to schedule interviews at this time due to their workload. The GMT was not able to schedule its first interview until October 20th 7 . As the interviews progressed, and the program review advanced, the Guidehouse team got an understanding of BakerRipley’s processes, an understanding of their operation structure, and weaknesses in the process. During the meetings, analysis of documents provided, and file reviews, the Monitoring Team identified multiple risks: 1. Lack of Complete Policies and Procedures. The policies and procedures provided did not include three key program requirements. The Scope of Services requires the administrator to verify the applicant’s age is 18 years old or older, or emancipated; the applicant must provide evidence of past due rent amount, and the tenant must certify that he/she is not receiving other housing subsidies from a local, state, or federal program. 2. Limited Software System Capability. BakerRipley relied on the Connective software system to collect information and documentation, send communications to landlords and tenants, and to verify property location within the geographical area and precincts. The online landlord application allowed owners to search the property address using a geomap system that verified if their property was located within the Harris County geographical area, but also allowed the owner to manually enter the property address in the application without location verification. In addition, Connective had several other weaknesses: a. Did not properly prevent payments above the capped amount of $1,900 per round of assistance causing overpayments, b. Did not prevent payments outside of the authorized month rent of November causing payments for December, c. Did not effectively prevent duplicate payments, d. Did not prevent staff from updating the application status during the window of the Pledge Report and Payment report causing to change the status to Assistance Not Provided when the payment was already released, e. Did not prevent payment disbursement of applications with ineligible Company/Property status and Case Closed Reason, f. Did not have either an aging capability or a reminder mechanism to assist staff in managing follow up requests for outstanding documentation when the application was in “In Progress” and “Eligibility Review Issue” status causing delay in processing these applications. 3. Staffing. BakerRipley utilized the same processing staff to administer three different programs. We were initially informed that the available staff processed applications for the Harris County RAP. We learned in interviews with key personnel that the same staff was utilized to administer the City of Houston and El Paso rental programs as well. The same staff also rotated to operate the call center. In addition, BakerRipley postponed CQA because the staff was redeployed to pull documents for GMT, but the staff was not deployed back to perform CQA. 4. Risk of Overpayments to Landlords. The process led to overpayments to landlords. The landlords were informed via email that the rental assistance was approved and the payment was disbursed shortly after the email was sent, without confirmation from the landlord that the amount was correct, overstated, or understated. The process did not allow time for the landlords to review the payment approval, respond back to BakerRipley, and provide BakerRipley time to correct the payment prior to disbursement. This process led to overpayments. 5. Fund Spending. The total funding amount for the RAP was $30 million. As of December 7th, BakerRipley disbursed approximately $14 million, or about 46% of the total funds. With 23 days left to spend the remining funds before December 30 the risk of errors increased in the attempt to spend the funds before the deadline. 6. Contingency Plan not developed and implemented. BakerRipley did not have a contingency plan. The purpose of a contingency plan was to allow an organization to return to its daily operations as quickly as possible after an unforeseen event. The contingency plan protects resources, minimizes program disruption, and identifies key staff, assigning specific responsibilities in the context of the recovery. 7. Lack of system testing documents. BakerRipley did not provide documentation regarding system testing to ensure system being used to support the RAP was designed and functioning as intended.

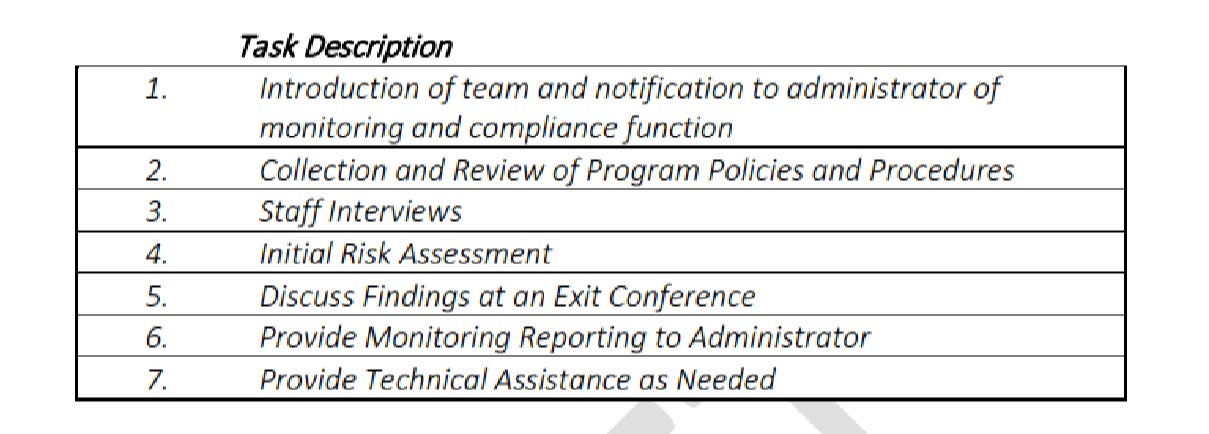

Monitoring Results The Monitoring Team’s work included documentation review, interviews and file reviews (both landlord and tenant). The report includes high level results, which are categorized as Findings and Concerns. A Finding is a violation of a statutory, regulatory or program requirement for which sanctions or other corrective actions may be issued. A Concern is a deficiency in program performance not based on statutory, regulatory or other program requirement. The County should work with the administrator to resolve findings by identifying a corrective action plan and recoupment of improper payments. If a finding or concern is not adequately addressed, it could present future audit risk, up to and including, recoupment of funds. A. Detailed Results 1. Findings a. Policies and Procedures: BakerRipley provided documented procedures. The GMT identified the following program requirements were not included: i. Proof of Unpaid Rent. BakerRipley’s Contract with Harris County8 required “The applicant must provide proof of unpaid rent by means of statements of rental payments due or notice of eviction.” The policies and procedures provided by BakerRipley did not include the collection of proof of unpaid rent. In addition, the initial 24 applications selected for review did not contain evidence of such documentation. Later, during our testing, the GMT found that 96.5% of the files were missing the document. ii. Eligibility/Proof of Age. BakerRipley’s Contract with Harris County9 states “Eligibility criteria: All residents age eighteen (18) or older (in addition to emancipated minors) may apply.” The policies and procedures provided by BakerRipley did not mention this eligibility criteria. The GMT found two (2) applications in which the applicant provided a work ID and a student ID that were missing the DOB and the age, key elements to verify if the applicants were 18 years old or older. iii. Eligibility/Participation in other Housing Programs. BakerRipley’s Contract with Harris County10 states “Eligibility criteria: The applicant must not be currently receiving housing subsidies from any other local, state, or federal programs (e.g. Section 8 or housing vouchers). BakerRipley’s application for the RAP program did not include a tenant self-certification that the applicant was not participating in other local, state, or federal housing program, and this requirement was not mentioned in BakerRipley’s procedures. The tenant application gathered information from the applicants regarding participation in various assistance programs. One of the programs listed was Public Housing Assistance. However, it was not a certification and it did not include other local and state housing programs. In our file review we found 5 files in which the applicants indicated that they were receiving Public Housing assistance. We then reviewed the entire program population and found 562 applicants that indicated that they were receiving Public Housing assistance and received RAP assistance as well for a total of $531,505 in disbursements . BakerRipley contacted the Harris County Housing Authority (HCHA) and was informed that five (5) families were HCV participants. It is unknown how HCHA reviewed the data to find 5 matches. BakerRipley did not state what action was taken in regard to these five (5) files. In addition, BakerRipley did not confirm if they contacted the Houston Housing Authority. b. The payment process led to overpayments to landlords. i. Landlords were informed via email/text that the respective rental assistance was approved. The payment was disbursed shortly after the email was sent without confirmation from the landlord that the amount was correct or possibly overstated or understated. This process did not allow time for the landlords to review the payment approved, respond back to BakerRipley, and give BakerRipley time to correct the payment prior to disbursement. ii. The GMT learned in an interview with one of BakerRipley’s staff that as of 11/23/2020 1,349 landlords confirmed that they were overpaid (this number included City and County). On the same day, the GMT requested the overpayment report and that BakerRipley separate the landlords that were paid from the County funds. On December 15th, the GMT received a report with data as of December 10th, reflecting that 207 landlords were overpaid $203,417. BakerRipley had recouped $108,458 of the amounts due to be repaid. The GMT requested an updated overpayment report, but we did not receive this by the time of this report. c. Accounting of Overpayments: BakerRipley’s process for recording accounts receivables did not follow accounting principles.

i. BakerRipley did not record the receivable in the accounting system immediately after an overpayment was known. Instead, the Accounting Department recorded the receipts in an excel report when the landlord returned the overpaid amount. ii. Tracking accounts receivables in an excel spreadsheet can lead to errors and omissions. Records could be deleted or incorrectly updated without and audit trail making the information unreliable. Accounts Receivables should be recorded in the accounting system, with the corresponding allowance account and bad debt expense account, and eventually written-off if the amount is not recovered. The GMT identified $1,146,226 in incorrect payments should be recorded as Accounts receivables. This amount does not include incorrect payments due to files missing proof of unpaid rent, full lease missing, incomplete W-9 forms, etc. d. Applicant File Documentation. BakerRipley did not provide all the documentation requested for review i. The GMT tested additional 395 files of which 106 were “Assistance Not Provided”, 163 “Assistance Provided”, and 126 “Assistance Pledged”. Please note that the files with “Assistance Pledged” were later changed to “Assistance Provided” after the payments were disbursed, hence, we grouped together these 2 categories. The table below summarizes the file review of the 289 files in which assistance was provided. The GMT did not find exceptions in the “Assistance Not Provided” selected files.

#1. The certification of no participation in other housing programs was a program requirement that BakerRipley did not include in its policies and procedures. The GMT addressed the omitted policy with BakerRipley’s management team early in the monitoring review and provided proposed language for the certification. However, BakerRipley did not implement the certification. The GMT found in the data that 562 applicants indicated they are receiving other housing subsidy.

$531,505 was dispersed to applicants that indicated they are receiving public housing assistance. #2. Proof of unpaid rent was a program requirement that was omitted in the policies and procedures. A few applicants provided the document without being ask and by coincidence.

#3. 65.1% of the files tested had incomplete leases. The applicant provided the first page or the lease summary page. To have a valid lease the signature page must be present. #4. For nine (9) files the GMT could not verify that the documents in the files justified an economic impact due to the COVID-19 #5. For three (3) W-9 forms the date was missing, one (1) had the date and the tax classification section incomplete, two (2) had the type of LLC missing, one (1) had the tax classification missing, and one (1) had the entity name missing. #6. The lease was a program requirement. The GMT found six (6) files without a lease. #7. The program requirement established the proof of economic impact must be dated on or after April 1st, 2020. The GMT found seven (7) records with economic impact dated before April 1st. #8. The four (4) records in which the EIN did not match the EIN on the landlord application corresponded to two landlords with a total of 239 units in the program (111 for 200 Hollow Tree LP and 128 for GVA Property Management) ii. For the review, BakerRipley provided a OneDrive shared folder and saved the documents requested for file review in this folder. The GMT requested all email communications sent to the tenants and the landlords for the initial 24 files reviewed. Eight (8) files had one (1) email communication to the tenant requesting additional documentation and three (3) files had one (1) email informing the tenant the assistance was approved. Based on BakerRipley’s communications schedule, we expected to find communications regarding applications not eligible for assistance, applications selected for assistance, applications selected for processing, assistance payment processed, and requests for additional documentation. BakerRipley management stated the emails are system generated after specific transactions are completed in the system. BakerRipley, however, was not able to produce the communications described in the policies and procedures manual. On December 17th, the GMT got access to Connective, the system of record, and found out the communications were present in the files in the form of SMS text messages. The SMS text messages would have fulfilled the request of communication documents.

The GMT also found in Connective documents that were not provided in OneDrive. These documents would have helped to clear. program requirements. For the files reviewed with status “Assistance Not Provided”, BakerRipley did not provide the GMT with sufficient documentation in OneDrive to determine the reason the assistance was declined. It was after the GMT accessed Connective and performed another file review that GMT could verify the reason assistance was declined. e. Program System Capabilities. Connective, the system of record, did not always perform as intended. i. Duplicate Payments. The GMT conducted a review on the entire population in search for potential duplicate payments and found 586 duplicates. We found files in which the applicant submitted two identical applications, applications using their first name and a second application using their middle name, and applications in which two household members submitted different applications. In some instances, the duplicate applications were paid for the same number of months’ rent requested and in other files the duplicate was for just one month (e.g. case #175737 was paid for June, July, and August and case #102003 was paid for July and August only. Both applications are for the same tenant and same unit address). In some instances, the duplicate month paid was for different amounts. The GMT informed BakerRipley of the duplicate payments and BakerRipley contracted with Moksha Data, a data consulting firm, to assist in finding duplicates in the total applications. Moksha data found 399 duplicates. 7 files were not considered duplicates, per BakerRipley’s determination. As a result, BakerRipley requested 392 repayments from landlords. The GMT requested that BakerRipley review the 162 duplicate files not listed in Moksha Data’s report (of 399). It is unknown to the GMT if BakerRipley reviewed the 187 additional duplicate files discovered. The average program assistance per applicant was $1,269, multiplied by 93 duplicates (half of 187 remaining unreviewed duplicate files) the potential overpayment could add up to $118,017. ii. Overpayments (Payments above $1,900). The GMT found in the file testing three (3) files that had an assistance payment amount greater than $1,900 . We searched the entire database for additional files, and found 376 files with overpayments. The overpayment amount varies between $6 and $2324 above $1,900. The total overpayment was $87,724.25. We immediately informed BakerRipley of our discovery. BakerRipley said it was a “system glitch”, the system was supposed to cap the total assistance per round to $1,900. On March 12, 2021, BakerRipley informed us in an email that all the landlords affected received a refund request letter sent via email and the system was documented accordingly. As of the date of the email, 161 overpayments had been received. BakerRipley did not indicate the amount collected for overpayments. iii. Payments assistance beyond November 2020. In our files testing we found one (1) file in which the landlord received a December payment. We searched the entire database for additional files and found 226 files with payments beyond November. The total overpayments were $144,571. We immediately informed BakerRipley our discovery. BakerRipley said it was a “system glitch”, the system 19 was supposed to limit the months of assistance to November 2020 per the program requirement On March 12, 2021, BakerRipley informed us in an email that all the landlords affected received a refund request letter sent via email and the system was documented accordingly. It is unknown to the GMT if funds were recovered. iv. Payments for months not owed. We reviewed the population data report in search for inconsistencies and found 11 records with status “Assistance Not Provided” that had a positive “Amount Spent” for a total of $10,609.40. Connective allowed the processors to update the application status in the window between the “Pledge Report” and the “Payment Report”. During this window, the program sent the Pledge Report to Finance to process the approved payments. After the payments were processed, Finance sent the Payment Report to the program and the program updated the files. The process took about a day to be completed. During this window, processors received a notification from landlords that the tenant did not owe the payments and the processors updated the files status to “Assistance Not Provided” when the assistance was already paid. BakerRipley stated that they sent a refund letter to the landlords affected after the GMT alerted them of the incorrect payments. It is unknown to the GMT if funds were recovered. f. Potential Fraud. i. The GMT found four cases associated with potential fraudulent applications. In two instances, the applicant (tenant) was also the landlord. In one instance, the applicant submitted two applications using her first and second name, and different email addresses. In the last instance, two different members of the household submitted applications. BakerRipley stated that they sent a refund letter to the landlords affected after the GMT alerted them of the potential fraudulent applications. It is unknown to the GMT if funds were recovered. ii. BakerRipley was notified by Fort Bend County that they discovered a fraud case in their rental assistance program and Harris County was also affected. The GMT found 90 files affected by the same scheme in the total population. None of the cases affected were selected for testing. BakerRipley has provided a detailed memo to the County based on their internal investigation. 2. Concerns a. BakerRipley appeared to be understaffed to administer the RAP i. Staffing for Application Processing. We learned that BakerRipley was performing the processing for three different rental assistance programs concurrently (Harris County, City of Houston, and El Paso) with the same staff. We were not informed of this situation in the first interviews with key management staff, and we understood the processing staff was dedicated to Harris County. In addition, BakerRipley redeployed the QA/QC staff to pull file documentation for the GMT’s 20 testing but never deployed the employees back to QA/QC, a critical task for the program. The GMT was unable to determine the impact to the Harris County RAP program of utilizing the same staff for three concurrent rental programs. In an interview on November 19th, we requested the daily staffing metric/productivity report BakerRipley used for oversight and management of staff activities and production. Reporting very low production volume, management staff mentioned that the low processing volume was due to the delay in getting additional documents from the applicants. The GMT made multiple requests to management to provide the metrics report. To-date BakerRipley did not provided the report, stating it was not relevant to compliance. ii. Call Center Staffing. We were informed that BakerRipley had a reduction in staff and that they utilize application processors on a rotating basis to staff the call center. This operational structure pulled away needed staff to complete the review and processing of applications and delayed the application approval and payment to landlords. b. Potential ineligible payments. Company/Property Status and Case Closed Reason In December 2020, we informed BakerRipley that we found 50 applications with ineligible Company/Property Status and 66 applications with ineligible Case Closed Reason. BakerRipley stated the status and case closed reason should be updated and that the file should have completed with correct documentation. BakerRipley reviewed and updated the status of 25 of the ineligible companies and 33 of the ineligible Case Closed Reason applications. We looked at the population report as of 02/24/2021 and found a total of 810 “Assistance Provided” applications that have and ineligible Company/Property Status with a total payment of $996,156.83 and 43 applications with and ineligible Case Closed Reason with $51,296.25 total payment. It is unknown if the assistance was correctly paid for these applications because the GMT did not receive a response from BakerRipley. c. The system (Connective) lacked a mechanism for follow-up of requested documentation, potentially delaying approval and payment. i. The GMT learned in an interview with BakerRipley staff that Connective, the system used for processing applications, maintaining correspondence, and producing pledge reports for payment, did not have either an aging capability or a reminder mechanism to assist staff in managing follow-up requests for outstanding documentation when the application was in “In Progress” and “Eligibility Review Issue” status. In contrast, we learned that applications in “Application Selected” status received weekly reminder emails if documentation was not received. ii. For applications in “In Progress” or “Eligibility Review Issue” status, the processors reviewed emails from applicants received in a general email inbox, and this was the mechanism by which applicants were moved out of those statuses. BakerRipley staff indicated that due to the high number of applications in 21 “Application Selected” status that needed an initial review, staff had been unable to perform secondary reviews on applications in “In Progress” or “Eligibility Review Issue” status. This process delayed processing timeframes and funding. iii. We learned through interviews that not all correspondence was required to be processed through Connective. Processors could receive documents from the applicants through general email inboxes. This procedure could potentially lead to the loss of documents, incomplete application files, and delays in processing. d. BakerRipley did not perform Internal Compliance and Quality Assurance (“CQA”) BakerRipley developed policies and procedures (BakerRipley Policy No. 1001) to conduct internal CQA to gain insight into the processes for compliance with regulatory requirements, BakerRipley process maps, and procedures. Guidehouse learned through interviews that BakerRipley did not performed CQA. Instead, BakerRipley redeployed the CQA staff to pull documents for the GMT but never deployed the staff back to performed CQA. A great number of applications with errors could have been corrected if BakerRipley would perform CQA in accordance with the policies and procedures they created. e. Lack of Responsiveness by the Administrator. BakerRipley’s Lack of responsiveness had been an impediment for the GMT team since the beginning of the compliance monitoring work. The GMT had to make requests multiple times with repeated follow-ups to obtain information, data, or schedule interviews. The lack of response delayed testing and led to delays in identifying compliance issues and deficiencies as well as a delay in program enhancements that could have improved the program, compliance with applicable regulations, policies and procedures, and facilitated operational enhancements. The table below illustrates multiple requests and the corresponding delay. The County was made aware of these outstanding information requests

The GMT performed an initial testing on 24 Round 2 applications12. The GMT was not granted access to Connective when requested, instead, BakerRipley provided the applications and documents in OneDrive, a shared folder, resulting in a delay in beginning the testing. Multiple requests were made to obtain the required documentation. The samples were selected from applications in three application status: a. Applications in Assistance Provided status b. Applications in Assistance Pledge c. Applications Assistance Not Provided The files were tested against the RAP parameters including the Harris County Rental Assistance Program Scope of Services, the RAP White Paper, and BakeRipley’s policies, procedures, and check lists. Testers reviewed all elements of the program parameters and requirements in the application file including, but not limited to: a. Landlord application b. Landlord ID c. W-9 form d. ACH information e. Rent amount due f. Property location within the geographical area g. Household income h. COVID-19 Economic impact i. Proof of residency For Assistance Not Provided applications, testers reviewed to ensure that the reason BakerRipley declined assistance was acceptable and supported by the file. The documentation provided in OneDrive, however, was insufficient for the GMT to make a determination, as the files were missing documents and communications, which were important to determine if the applicants were given the opportunity to provide additional documentation before deemed ineligible. For files in status Assistance Pledged and Assistance Provided, testers reviewed to ensure all required documents were in the file, were properly completed, the applicant’s income was below 60% HAMFI, and the total assistance did not exceed $1,900. The initial sample reviewed was comprised of eight (8) Assistance Provided, eight (8) Pledge, and eight (8) Assistance Not Provided. We identified deficiencies in all files with status Assistance Provided and Pledged. After testing the initial sample of 24 files, the team met with BakerRipley on December 7th to discuss the testing results. The GMT also provided the record numbers and the observations for each record in an excel report and requested that BakerRipley provide an explanation for each case. To date, we have not received BakerRipley’s response.

The GMT selected additional files for testing 11/24/2020, 12/02/2020 and 12/23/2020. BakerRipley provided documents in their shared folder OneDrive for the selection from 11/24 and 12/2. However, the documentation was incomplete and took several days to provide de documents. The GMT got access to Connective on 12/18/2020 and could then perform a full review of the selections. The GMT also reviewed the population RAP County Cases report which contained all the applications. The intent was to verify if the application status was consistent in relation to the Company/Property status and the Case Closed Reason. We found that 50 applications with status Pledge and status Assistance Provided had a Company/Property Status that were ineligible to receive rental assistance and 66 applications that had a Case Closed Reason that were ineligible to receive assistance. We communicated the discrepancy to BakerRipley and they responded that the status and case closed reason needed to be updated. BakerRipley did not fully address the concern. To-date, 25 of the 50 files still have an ineligible Company/Property status and 33 of the 66 files still have an ineligible Case Closed Reason. We recently looked at the population report as of 02/24/2021 and found a total of 810 “Assistance Provided” applications that have and ineligible Company/Property Status with $996,156.83 disbursed and 43 applications with and ineligible Case Closed reason with $51,296.25 disbursed.

VII. Conclusion The Guidehouse Monitoring Team findings, based on our review, supports that BakerRipley did not appear to administer the program entirely within Treasury and County requirements. BakerRipley lacked complete procedures reflecting all program requirements, and file testing indicated that files were approved and paid with incomplete documents. In addition, BakerRipley made a number of improper payments associated with system errors. The errors did not happen throughout the program but rather during short periods of time. It also appears that BakerRipley had insufficient staffing capacity, and necessary tools and controls to administer the program. As a result, the Monitoring Team does not, at this point, have assurance that all program funds have been disbursed appropriately. The Monitoring Team recommends that to mitigate the risks associated with the deficiencies identified in this report, BakerRipley work with the County to develop, document and execute a corrective action plan. The County should work with the administrator to resolve findings by identifying a corrective action plan and recoupment of improper payments. If a finding or concern is not adequately addressed, it could present future risk to the County, up to and including, recoupment of funds. 2

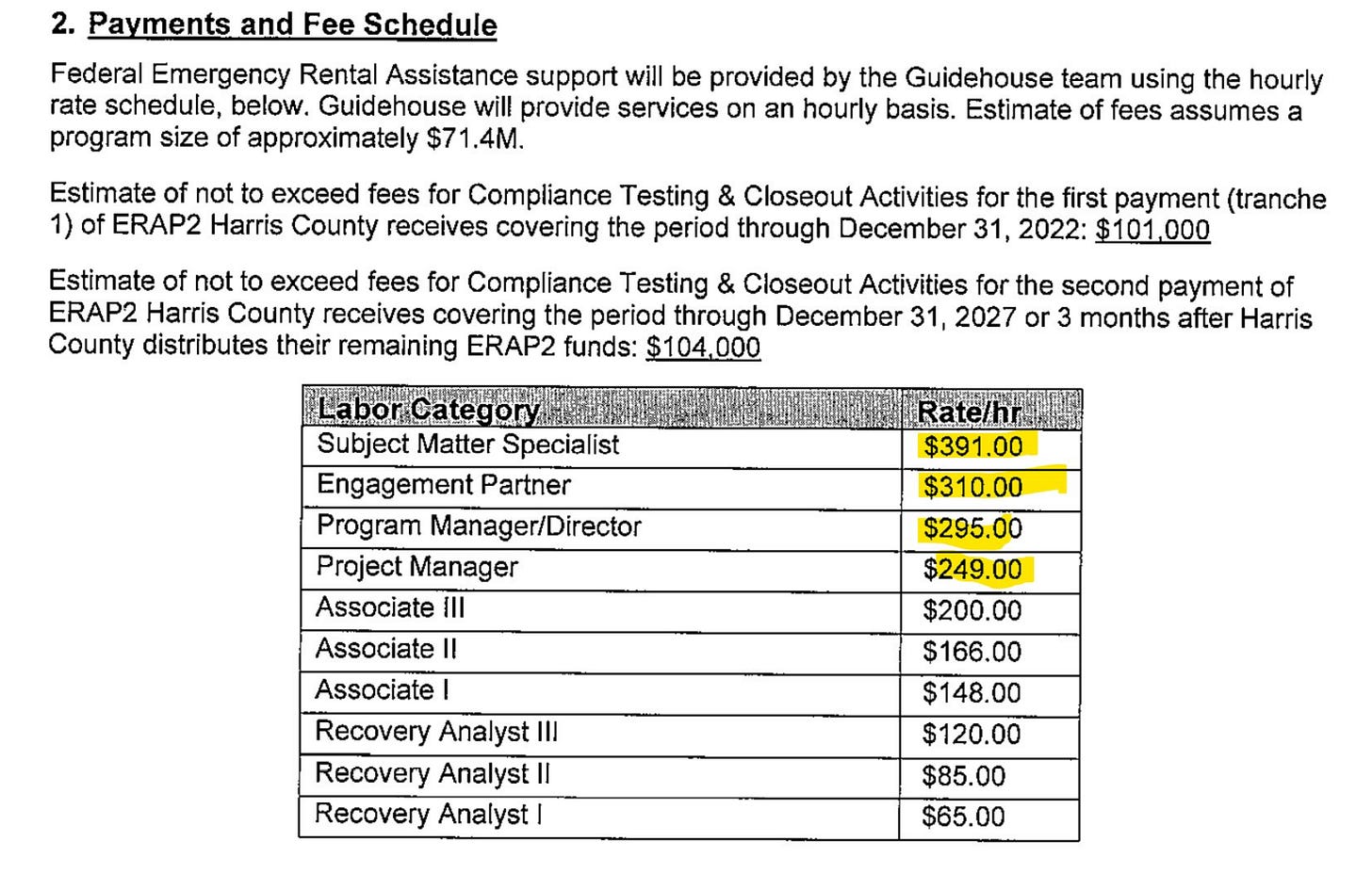

Shortly after these findings. Guidehouse was brought on board to provide “technical assistance” for $717 THOUSAND DOLLARS.

SIDE NOTE: BAKERRIPLEY HAS AN OFFSHORE BANK ACCOUNT IN THE CAYMANS…….

THIS IS JUST THE TIP OF THE ICEBERG.

Interestingly, MANY LOCAL DEMOCRATS worked at Bakerripley before getting jobs with the city and nonprofits the Democrats formed. LIKE LINA’S FORMER CHIEF OF STAFF ALEX TRIANTAPHYLLIS

There you go again, following that Democrat money.